Sales

See what our customers are saying

about ChangingProperty.com

about ChangingProperty.com

Establish the value of your current property

A realistic assesssment of the value of your property is an important first step to ensure you understand how you will finance your home move.

Whilst local property newspapers and websites can be used to provide an indication of what your property might be worth, you will need the experience of a professional estate agent to get a more accurate and realistic assessment of its real value.

We will be happy to provide you a free , no-obligation, property appraisal.

We can meet you at your property a time that best suit your needs. Our appointment with you would typically take between 30-60 mins and would include a detailed inspection of your property. At our meeting, we will discuss the specific needs relevant to your own situation, market forces and current demand, previous transactions in your street and activity levels with other property similar to your own. This information will help us advise you on:

- The potential value range applicable to your property

- Anything you could do to enhance this value, and

- A recommended marketing strategy that suits your particular objectives.

Select an estate agent

Having established the value of your property and decided to go onto the market, you will need to choose an Agent to act for you. When considering which agent to use, watch out for those suggesting inflated values (which can leave you languishing on the market whilst those around you sell) or knock-down commission (you get what you pay for!).

A successful agency will have a comprehensive marketing strategy and methods, professionally qualified & courteous staff and a realistic expectation of what the market can achieve.

With us, you only pay commission when we successfully sell your property and you’ll always have access to a specialist team dedicated to sales. But, beyond that, we provide a significantly higher level of service that you would typically expect from a traditional estate agency.

Contact us to find out more about what we offer you.

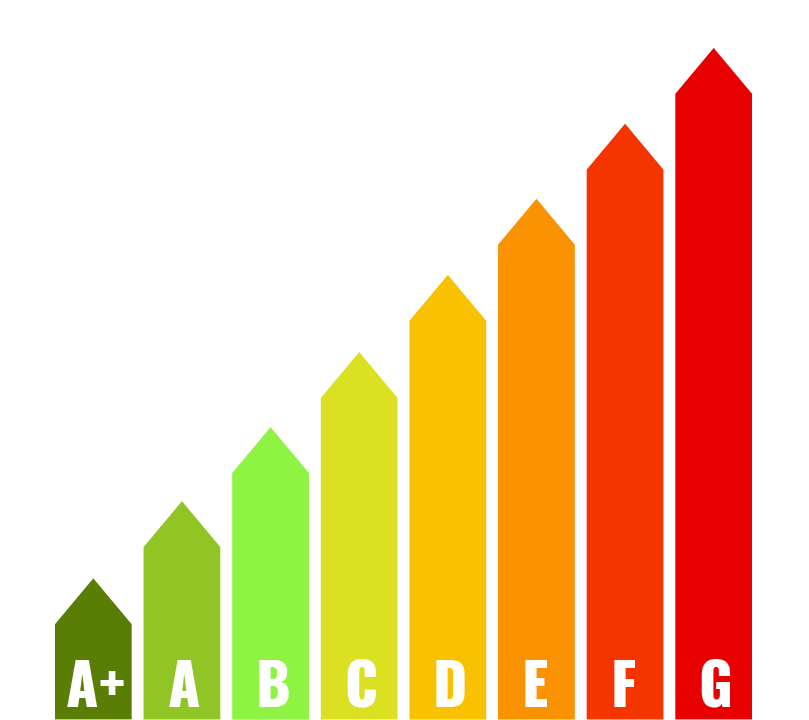

Arranging an EPC Certificate

An Energy Performance Certificate (EPC) for a property is a legal requirement. With our HIP partners, we can arrange to have an EPC produced for you, quickly and without fuss – and at a very competitive rate!

Preparing your property – to maximise its saleability and/or price

The majority of buyers now use internet property portals to search for a home. Therefore the visual imagery used with these listings are the first taste of your home a potential purchaser is likely to experience and this will be hugely influence whether they contact us to arrange a viewing.

Preparing your home for photography and other visuals we develop (such as videos) is therefore one of the most important actions you can take to maximise your chances of attracting interest. This could involve some moving of furniture and basic de-cluttering.

With us, you don’t have to – as we can do all this for you as part of the instruction process. Our consultant will allow enough time to work through your property on a room-by-room basis to carefully consider the best layout of furnishings, removal of personal items and the best aspects to capture. Room dimensions and details will be recorded and a plan of the property will also be drawn.

Conducting viewings

Estate Agents commit huge amounts of time and money towards marketing properties to prospective purchasers – with the prime aim of encouraging them to view the property.

We will discuss with you the best times of the day & week to present your property and do our best to steer appointments around these times. Many considerations need to be made, including your normal weekly patterns, parking availability and traffic levels, children and pets, light levels and garden aspects.

Negotiating the deal

Any offer received will be put forward to you verbally at the first available opportunity, and in writing within twenty-four hours. You will need to make a response to any offer. If the initial offer is rejected and the purchaser decides to increase their offer, the process will simply be repeated.

We will make all best endeavours to qualify purchasers in advance of any viewings – but at the very latest, at offer time. By “qualify” we mean that we will formally check their status and ability to proceed with any offer they make. In order for us to do this, we will ask for contact details of their broker or mortgage lender, and any estate agent dealing with their current property sale.

You will need instruct a solicitor/conveyancer to act for you in the sale. It is only when this information has been provided and we have contacted the necessary parties for verification of your purchasers’ situation that we will consider whether it would be pertinent to stop showing your property to other prospective purchasers.

It is at this stage that we will try to make you aware of any chain implications and the likely timescale of any agreed transaction. Due to the nature of the buying process, it is important to note and understand that any information provided by us concerning the transaction chain is not guaranteed and could change at any time. However, regular liaison will be made with legal parties acting on both your and your buyers behalf to ensure we can keep you abreast of progress on a timely basis.

Completing contracts

Once you have accepted an offer the legal process starts to arrange for contracts to be drawn up and agreed, to confirm payment is made for your property, and that legal title is properly transferred to your buyer.

To support these activities you (and your buyer) will need to instruct a solicitor or conveyancer to do this work on your behalf. The choice of who will act for you is entirely at your discretion but to help you with this, we promote a range of different and very competitive conveyancing options. Please contact us for further information.

Summary of the legal process

In summary, the overall legal process to exchange and complete contracts with your buyer generally takes the following steps:

Our advice: The time it takes to progress through this stage is dependent on various factors – but the entire process could take at least 6-8 weeks. However, to speed up the process from your end, we recommend you instruct legal representation prior to finding a buyer as there are various things they can do well in advance, and hence save time later.

This includes calling for your title deeds office copy entries and various other documents – all of which can take some time to get hold of. Its worth completing various documents in advance – such as the “Sellers Property Information Form” and “Fixture Fittings and Contents” declaration – as these will also help speed up things later.

- Terms are agreed between Seller and Buyer and both parties instruct their conveyancer to work for them.

- The Seller’s conveyancer obtains the Seller’s title deed and prepares the draft Contract for the Buyer’s conveyancer to approve

- The Seller’s conveyancer send to the Buyers conveyancer the draft Contract together with rest of the documentation needed to form the overall contractual package.

- The Buyer’s conveyancer reviews the detailed terms of the Contract, does the Searches and reviews the results, confirms that there is a Mortgage Offer in place, and also checks the readiness of any dependent sale (in the same chain) to proceed.

- Contracts are then signed and exchanged at which time a Completion Date is agreed between both parties.

- The Transfer Deed is prepared by the Buyer’s conveyancer and approved by the Seller’s conveyancer, and then signed in readiness for the Completion Date.

- The Buyer’s conveyancer obtains the funds for the purchase from the Buyer – either directly, or though the sale of his/her previous property – and the lender (if there is a Mortgage)

- On the Completion Date the Buyer’s conveyancer sends the required funds to the Seller’s conveyancer (on behalf of the Seller). When receipt of these funds is confirmed by the Sellers conveyancer, the purchase is deemed compete and the Buyer can take legal occupation.

- The Buyer’s conveyancer pays any Stamp Duty due, and registers the Buyer as the new owner of the property at the Land Registry

Surveys

In parallel to the legal process, one of more surveys may be commissioned on your property. If the Buyer requires a Mortgage their lender will make arrangements for a very basic survey (known as a Valuation) to provide assurances that it’s worth the price being offered for it. In addition to this, the Buyer may also commission a more comprehensive survey – which will assess in more detail the condition of the property and make appropriate recommendations.

Buyers

Sell your existing property (if you have one)

If you have a property to sell, the first step you should take is to put it up for sale.

Why? Because, if you see a house you want to buy you may not be able to buy it without the money from your own house. Also, many estate agents consider you a “non-proceedable” buyer – which means, you are a potential buyer but you can’t actually proceed because you need to sell your own house first. So, if there is another buyer who is “proceedable” they may well see the house of your dreams and buy it first!

We can help you in sell your home. Click here to arrange a free, no-obligation valuation of your home or Contact us.

Work out what you can afford

On top of the cost of the house itself, there are many other one-off expenses involved in buying a home and moving.

- Mortgage Arrangement Fees – A fee charged by lenders to cover the cost of setting up the mortgage. Some lenders waive this fee. Our partners, a firm of professional, independent financial advisors, would be pleased to provide you with a free, no obligation consultation on what mortgage options are available to you, and the associated costs.

- Lender’s Valuation (Basic Valuation) – All lenders require a valuation of the property to assess whether it is actually worth the price being paid for it. This type of valuation is organised by the mortgage lender but you will be expected must cover their costs. The cost of the valuation depends on the value of the property.

- Professional Survey – You may wish to commission a more detailed survey in addition to the basic mortgage valuation. There are generally two types of survey: the Homebuyer’s Report (which costs around £500) and the more comprehensive Building Survey (Structural Survey) which could cost anything up to £1,000, depending on the value of the house. A professional survey can be arranged for you through us, please Contact us for more info.

- Legal/Conveyancing Fees – You will also need to instruct a solicitor to deal with all legal aspects of buying the property you want. We promote a range of different and very competitive conveyancing options – please ask us to find out more.

- Stamp Duty – This is a government tax, charged for purchase of properties above £125,000. If your new home is priced between £125,000 and £250,000, you will need to pay 1% of the final agreed price. If its between £250,000 and £500,000, the tax is 3%; and over £500,000 its 4%. So, for example, if you are paying £200,000 for your home you will be expected to pay £2,000 in stamp duty – i.e. 1%.

- Land Registry Fee – The Land Registry is the government department that manages the register of all properties in England and Wales. It charges a fee – typically £40 or so, but is dependent on the property price – for transferring the register to the new owner.

- Local Authority Search Fees – Local searches will be carried out by your solicitor/conveyancer to ensure there are no potential problems such as planning permission on neighbouring properties or plans for new roads nearby. The fee can vary depending on which local authority your new home is located in, but you should budget around £150 to cover this charge.

- Other Search Fees and Disbursements – These include an index map, commons, the coal authority, land charge, company searches, bank transfer fees. Allow about £70 to cover an average house purchase.

- Sales / Estate Agent’s Commission – If you’re selling your property as well as buying one, the sum charged by your estate agent has to be taken into account. Usually this is charged as a percentage of the property price. Please call Contact us online to learn more about or fees and related services.

- Removal Fees – if you’re on a tight budget, you could arrange to do all the packing and removals work yourself. However, given the scale of this task, we recommend you seek professional assistance. We have partnered with removals services

Get a “Mortgage in Principle”

Getting a mortgage and buying a house are usually very much intertwined.

When you find a house, you’ll probably have to move fast to secure it. To prevent being delayed while sorting out a mortgage we highly recommend you first get a “Mortgage In Principle” agreed. Having this in place means you should be able get the actual mortgage quicker when the race to buy your chosen home begins. You can get this offer in writing to show to Estate Agents and sellers – who will then see you as a serious prospect and not a timewaster.

A ‘Mortgage In Principle’ is a conditional offer made by a mortgage lender that – provided the information you give them is correct – they will “in principle” give you the loan you have discussed with them. Knowing what you can afford will also help you narrow your search and give you a considerable degree of confidence.

Our partners, a firm of professional, independent financial advisors, would be pleased to provide you with a free, no obligation consultation on what mortgage options are available to you, and the associated costs. Contact us to find out more.

Register with us

Once you have worked out how much you can afford the next stage is to start looking for a property.

To find your ideal property, we need to know as much as possible about your requirements. You can register with us either online, by phone or by visiting our offices, where one of our consultants can assist you with your search.

Once we have a clear understanding of your requirements we will access all properties that match your criteria. When you have registered, details of suitable properties can be sent to you by SMS, email or in the post – depending on your preferences.

View Properties

This is the fun bit!

Its always good to have a good brainstorm about what exactly you will be looking for in your new home. After all, you can’t ask for a refund if you decide you don’t like it after four weeks! You may well have to make some compromises in the house you buy so decide now what your “MUST HAVES” and “NICE TO HAVES” are. For instance: is an ensuite bathroom a MUST HAVE or a NICE TO HAVE? Remember: Consult your husband/wife/partner and children – so that you are all clear and agreed on what’s really important to you.

Viewings properties on our books

Viewings can be conducted from 9am – 7pm Monday to Friday and 10am – 5pm on Saturdays. You can book a viewing by phone Monday to Friday 9.00 am – 6.00 pm, Saturday 9.00 am – 5.00 pm, Sunday by appointment. You can also book a viewing on-line through the ‘Book a Viewing’ link presented against each property you find on our property search engine.

We usually conduct all property viewings as the Vendor may not always be present. Sometimes, a vendor gives us specific times for viewings, although we do ask them to be as flexible as possible.

After the viewing we will answer any immediate questions and usually contact you the next day for your thoughts and general feedback.

Please be on time for viewings. We will arrange to meet you at the property, or if it is more convenient, at our offices from where we can take you by car. Sometimes we can collect you from your home or your place of work, depending on where these may be.

Viewings properties on our books

We also offer a property search service to serious but busy buyers, who have limited time to spend in looking for a home. If this is you, this service could save you a ton in time and money. Contact us for more information.

Make an offer

How exciting! – You’ve found the house of your dreams and you want to make an offer.

Let’s hope we’ve found it for you.

As soon as you’ve found a suitable property, we’ll put your offer to the seller, verbally and in writing. We always aim to communicate your offer on the same day. The offer will be subject to a contract being signed and there are no legal obligations on either side until this is done.

Sometimes there may be a process of price negotiation and by working with us, both vendor and buyer can benefit from the expertise of our consultants, who will work hard to facilitate an agreeable outcome that delivers the best result for all.

Exchange and complete contracts

When your offer is accepted, the vendor’s solicitor/conveyancer will prepare a Contract of Sale. You will also need to appoint a solicitor/conveyancer to examine the contract, and raise any queries based on the title deeds and related property matters. To help secure a legal professional, we offer a range of different and very competitive conveyancing options that you can choose from. Please Contact us to find out more.

When your Solicitor has replies to their enquiries, a completed satisfactory local search, a copy of a mortgage offer, a signed contract and a deposit cheque, they can then proceed to Exchange of Contracts. A deposit cheque is normally required for 5-10% of the purchase value of the property.

We recommend that by this stage you confirm arrangements for moving day – i.e. a removals service. With us, we can put you in touch with one of our reputable removals firms. Contact us o learn more about this removals service.

Contract completion can be on the date of exchange or can be anything up to 28 days later, depending on your requirements. On Completion your solicitor hands over the remainder of the purchase money to the vendor’s solicitor and you can then move into your new home. Keys will be handed over to you by us, along with a “welcome pack” that includes various items of information that we expect will be of help to you – including final meter readings for electricity/gas, location of water stopcocks, meters, and so forth.

Please Contact us for any further information, advice or help you may need to help you with buying your next home.